Navigating the process of opening a business bank account as a non-resident in Dubai may seem like a complex task, but with the right guidance, it becomes a seamless experience. Essential steps, requirements, and considerations ensure a smooth and efficient establishment of your business. Whether you’re setting up a branch, representative office, or a new venture, Dubai’s banking sector is well-equipped to cater to the diverse needs of international businesses.

Easiest way to open a Business Bank Account in UAE

To start your career as an entrepreneur especially when you migrate to a new country/region may seem and feel daunting. Aspiring to do so within UAE is a great choice due to the availability of multiple option you have which will make this process far easier than you think.

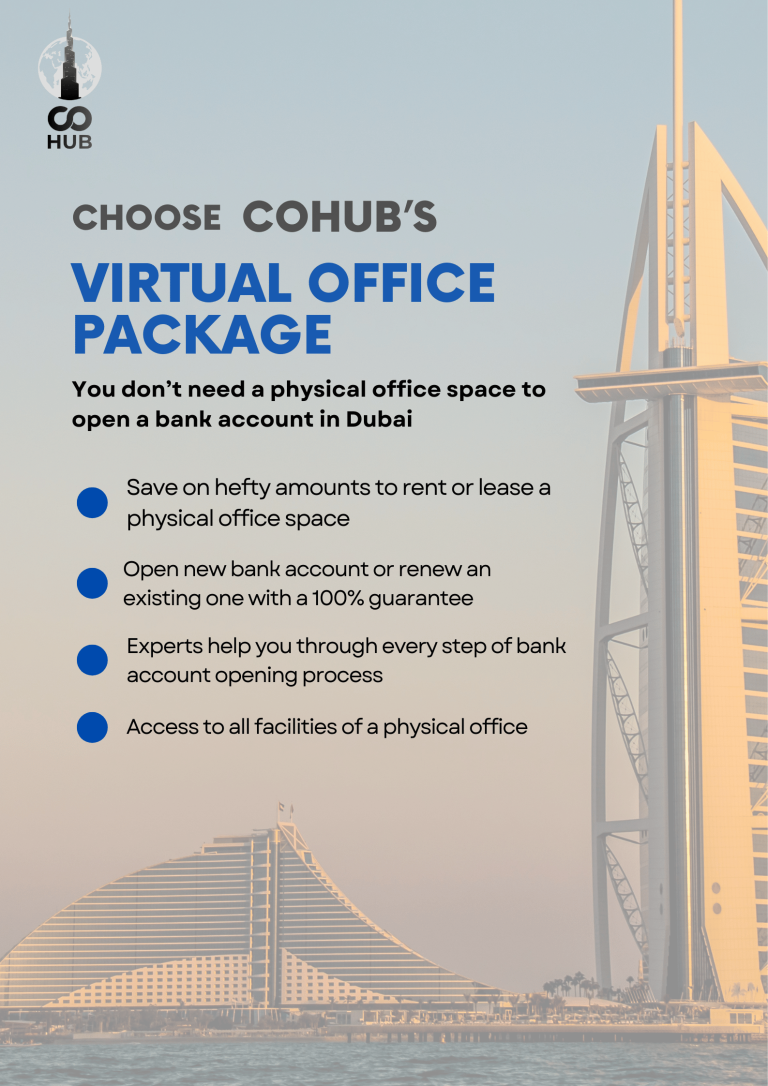

Cohub’s virtual office with tenancy contract package is the best option for you as a business owner.This particular package can save you hefty amounts and will provide you with specialised experts to guide through every step through the bank account opening process. How? You may ask… You can find the answer with the below points:

- Get a your virtual office space in a prime location within Dubai without actually renting or leasing one

- Save on huge office rental/lease expenses

- Use this virtual office address to open a new bank account or for renewal purposes with a 100% guarantee

- Expert assistance and support from our professionals until you get your bank account opened

- Access to free unlimited physical and telecom bank inspections

- A professional receptionist at your service

- PO Box facility

- And all other major accessibilities you would possibly require if you got a physical office space

Benefits of opening a Dubai business bank account for non residents

Opening a business bank account in Dubai for non-residents can offer several benefits. Here are some potential advantages:

- International Business Hub: Dubai is a global business hub located between Europe, Asia, and Africa. Having a business bank account in Dubai can facilitate international transactions and make it easier to do business with companies from different parts of the world.

- Tax Benefits: Dubai is known for its favourable tax environment. The United Arab Emirates (UAE) does not impose personal income taxes or corporate taxes in most sectors, making it an attractive location for businesses seeking tax efficiency.

- Stable Banking System: Dubai has a well-established and stable banking system. You get access to a wide range of financial services, including online banking, corporate credit cards, and business loans.

- Currency Options: Dubai offers the flexibility to operate accounts in various currencies. This can be advantageous for businesses engaged in international trade, as it allows for transactions in different currencies without the need for frequent currency exchanges.

- Asset Protection: Dubai has strict financial privacy laws, which can provide a level of asset protection for business owners. The confidentiality of financial transactions is often considered an essential factor for businesses, and Dubai's legal framework supports this.

- Ease of Doing Business: The UAE, including Dubai, has made efforts to improve its business-friendly environment. Streamlined processes for company registration and banking make it relatively easy for non-residents to set up and operate businesses in the region.

Steps to Open a UAE Non-resident Business Bank Account

Opening a non-resident bank account in the United Arab Emirates (UAE) typically involves several steps. Make sure to follow all the requirements and procedures accordingly to activate your account with minimal effort. Listed below are the steps along with the required documents to open a bank account.

1. Choose a Bank:

Research and choose a bank that suits your business needs. Consider factors such as fees, services offered, and the bank’s reputation.

2. Visit the Bank:

Go to the bank branch in person. Many banks in Dubai require physical presence for account opening, especially for non-residents.

3. Inquire About Requirements:

Speak with a bank representative to get a list of specific requirements for non-resident business account holders.

– Passport copies of shareholders and directors.

– Proof of business existence (e.g., trade license or certificate of incorporation).

– Business plan.

– Reference letters from a bank or professional.

4. Complete the Application Form:

Fill out the business account application form. Provide accurate and detailed information about your business activities, shareholders, and directors.

5. Submit Documentation:

Prepare and submit the required documents.

– Passport copies of shareholders and directors.

– Proof of business existence (trade license, certificate of incorporation).

– Business plan outlining your company’s activities and financial projections.

– Reference letters from a bank or professional.

6. Initial Deposit:

Be prepared to make an initial deposit into the account. The amount required varies among banks, so check with your chosen bank for their specific requirements.

7. Business License:

Ensure that your business has a valid trade license from the relevant authorities in Dubai. The bank will likely require a copy of this license.

8. Approval Process:

The bank will review your application and documentation. This process may take some time, so be patient. Some banks may conduct background checks on the company and its directors

9. Collect Account Details:

Once your application is approved, collect your business account details, including account number and other relevant information.

10. Activate Online Banking:

Many banks offer online banking services. Activate your online banking facilities for convenient management of your business finances.

11. Collect Debit/Credit Cards:

If your business account includes debit or credit cards, collect them from the bank.

Learn more – LLC company setup guide

Common Challenges Faced Opening a Business Bank Account in Dubai

There are certain challenges and reasons for denial that you should be aware of while applying for a bank account. Here are some common challenges faced when applying and the reasons for which they may not get approved:

- Incomplete or missing documentation is a common reason for denial. So ensure you have all necessary documents, including business registration documents, passport copies, proof of address, and any additional documents required by the bank.

- Some banks may have restrictions on certain business activities. Therefore, verification of your business activities should comply with the bank’s policies. Certain industries, such as those related to gambling or high-risk financial activities, may face more scrutiny.

- Banks may assess the risk associated with your business type or industry. An unfavourable business profile is a very common reason for rejection. Be prepared to provide a detailed business plan and demonstrate the legitimacy of your business. This includes showcasing a solid financial history, reputable partners, and a clear business purpose.

- If your business or personal profile is associated with high-risk jurisdictions or activities, banks may be hesitant to open an account. Be aware of international regulations and ensure your business is not involved in activities that may raise red flags. Provide evidence of your business’s compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

- Some banks may require businesses to have a physical presence in the UAE. Without establishing a local presence, such as an office or a representative, to enhance your credibility and meet the bank’s requirements, the possibility of setting up your business gets harder.

- If the source of your funds is unclear or questionable, it may lead to denial. Clear articulation of the source of your funds, especially if they involve international transactions is required as transparency is key to gaining the bank’s trust.

- Poor personal or business credit history can be a barrier as a credit history with good standing is required. The address should not have any outstanding issues before applying for a business bank account.

- Changes in local regulations or banking policies can impact the approval process. Staying un-informed about regulatory updates can lead to problems as the application must be adjusted accordingly.

The specific documents required for setting up an LLC in Dubai can vary depending on factors such as the nature of your business activity and the specific jurisdiction within Dubai. However, here is a general list of documents that are typically needed for the LLC registration process.

Send Us A Quick Enquiry

Send Us A Quick Enquiry

Speak To Our Consultant

Cost Calculator

Business Cost Calulator

Frequently Asked Questions

Different banks may have varying requirements, but generally, various business entities such as free zone companies, offshore companies, and onshore companies can open business accounts.

Yes, most banks will require an initial deposit. The amount varies depending on the bank and the type of account.

The timeline can vary, but it typically takes a few weeks. Factors such as the completeness of documentation, background checks, and other compliance procedures can influence the processing time.

Banks may charge various fees, including account opening fees, monthly maintenance fees, transaction fees, and currency conversion fees. It's essential to inquire about the fee structure beforehand.

Many banks in Dubai offer multi-currency accounts. This can be beneficial for businesses engaged in international transactions.